Finding reliable and affordable homeowners insurance is a top priority for millions of Americans. With unpredictable weather events, rising property values, and unexpected damages, it’s crucial to protect what matters most — your home. State Farm, one of the largest and most trusted insurance providers in the United States, offers a fast and free homeowners insurance quote service online. Whether you’re a new homeowner or looking to switch providers, getting a quote has never been easier or more important.

This article guides you through how to get a fast and free State Farm homeowners quote online, the benefits of doing so, what coverage options are available, and how you can save significantly while ensuring top-tier protection. With clear information, helpful bullet points, and an easy-to-understand layout, you’ll walk away confident in your ability to make a smart decision — and possibly lower your current premiums.

How to Get a Fast & Free State Farm Homeowners Insurance Quote Online

Getting a quote online from State Farm is a simple, straightforward process designed to help you compare coverage options and pricing without pressure. The user-friendly interface allows homeowners and potential buyers to receive a personalized quote in just minutes.

Step-by-step process to request your quote:

- Visit the Official State Farm Website

Navigate to statefarm.com and click on the “Homeowners Insurance” section. - Enter Your Zip Code and Home Details

Provide basic information like your zip code, address, year the home was built, and other details such as square footage and roofing type. - Input Personal and Household Details

Information such as the number of residents, pets, security systems, or fire protection systems can impact your quote. - Customize Your Coverage Options

Choose the level of coverage, deductible amount, and optional add-ons based on your preferences and property needs. - Receive Your Quote Instantly

In less than five minutes, you’ll receive a detailed quote outlining your premium, coverage limits, and available discounts.

Key Benefits of Online Quotes:

- 24/7 Access – Request a quote anytime, from anywhere.

- No Agent Pressure – Explore your options without commitment.

- Fast Turnaround – Instant quotes with no long waits.

- Customized Estimates – Tailored to your home, needs, and budget.

- Real-Time Savings – Identify and apply discounts immediately.

With these steps, homeowners can feel empowered and well-informed before committing to a policy. The quote tool not only helps in comparing prices but also provides a clear understanding of the protection included in each policy tier.

Compare State Farm Homeowners Coverage Options at a Glance

The following table outlines the core and optional features you can expect from a State Farm homeowners insurance policy. Use this to evaluate which coverage fits your needs best.

| Coverage Type | Included in Basic Policy | Optional Add-on | Details |

|---|---|---|---|

| Dwelling Coverage | ✅ Yes | ❌ No | Covers repairs/replacement to your home’s structure. |

| Personal Property | ✅ Yes | ❌ No | Protects furniture, clothing, electronics, and personal belongings. |

| Liability Protection | ✅ Yes | ❌ No | Covers legal and medical costs if someone is injured on your property. |

| Loss of Use (ALE) | ✅ Yes | ❌ No | Pays for temporary living expenses during repairs. |

| Medical Payments to Others | ✅ Yes | ❌ No | Provides coverage for small injuries without needing a lawsuit. |

| Identity Theft Protection | ❌ No | ✅ Yes | Helps you recover from identity theft with financial/legal support. |

| Earthquake Insurance | ❌ No | ✅ Yes | Covers damage from seismic events; necessary in high-risk areas. |

| Flood Insurance | ❌ No | ✅ Yes (via NFIP) | Required in flood-prone areas; separate policy through National Flood Program. |

| Equipment Breakdown | ❌ No | ✅ Yes | Covers HVAC systems, appliances, and electrical systems due to failure. |

| Green Home Upgrades | ❌ No | ✅ Yes | Pays extra to replace materials with eco-friendly upgrades. |

This breakdown ensures homeowners understand not just what they’re paying for, but how each option adds value and peace of mind to their investment.

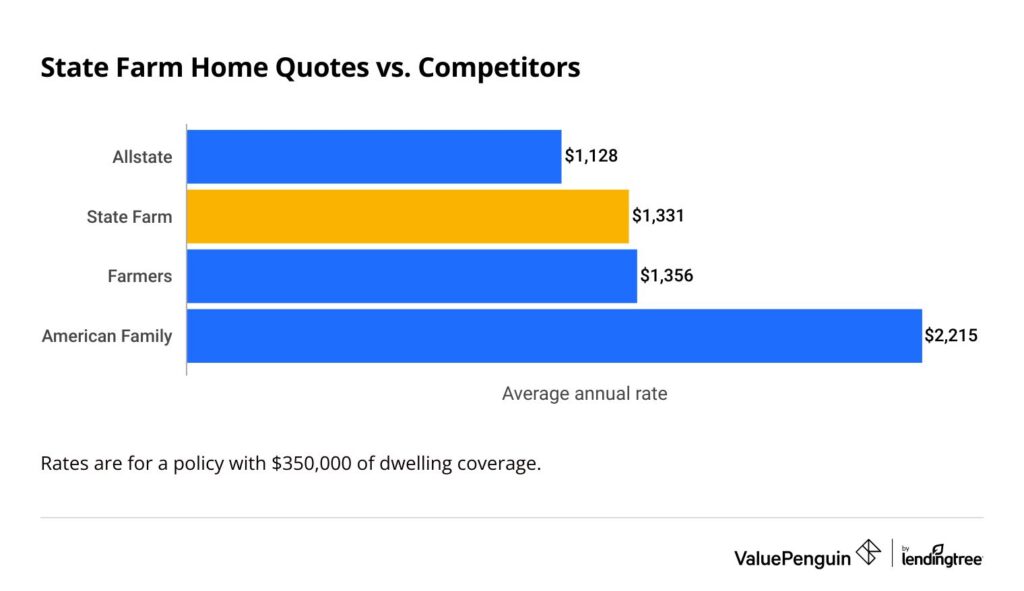

State Farm vs. Competitors: Is It the Right Choice?

| Provider | Online Quote Available | Average Premium | Claims Satisfaction | Bundling Discounts | Standout Feature |

|---|---|---|---|---|---|

| State Farm | ✅ Yes | $1,500/year | ⭐⭐⭐⭐☆ (4.2/5) | ✅ Yes (up to 17%) | Strong national agent network |

| Allstate | ✅ Yes | $1,600/year | ⭐⭐⭐⭐☆ (4.1/5) | ✅ Yes | Innovative digital tools |

| Liberty Mutual | ✅ Yes | $1,700/year | ⭐⭐⭐⭐☆ (4.0/5) | ✅ Yes | Good optional add-ons |

| Farmers Insurance | ✅ Yes | $1,800/year | ⭐⭐⭐☆☆ (3.8/5) | ✅ Yes | High customizability |

| USAA (military) | ✅ Yes | $1,200/year | ⭐⭐⭐⭐⭐ (4.8/5) | ✅ Yes | Best for military families |

Verdict: For most homeowners, especially those looking for an easy online quote and nationwide support, State Farm stands out with its balance of affordability, reliable customer service, and available discounts.

Tips to Save Big on Your State Farm Homeowners Insurance

Even with competitive pricing, homeowners can take proactive steps to lower their premiums. Below are proven ways to maximize savings while maintaining high-quality coverage.

✅ Bundle Your Policies

- Combine home and auto insurance with State Farm and save up to 17% or more.

- Bundling makes managing policies easier and often unlocks additional discounts.

✅ Increase Your Deductible

- Choosing a higher deductible (e.g., $1,000 instead of $500) can significantly reduce your annual premium.

- Make sure you have an emergency fund to cover out-of-pocket costs if needed.

✅ Install Safety Devices

- Get discounts for smoke detectors, burglar alarms, and water leak sensors.

- Some systems may qualify you for advanced protective device credits.

✅ Maintain a Good Credit Score

- Insurers often consider credit-based insurance scores. A better score can mean lower premiums.

✅ Review Your Policy Annually

- Adjust your coverage as your property value or needs change.

- Avoid paying for more coverage than necessary — or discovering too little coverage after a claim.

Final Thoughts

Homeowners insurance is more than just a policy — it’s peace of mind. With State Farm’s fast and free online quote tool, you can explore coverage options, understand costs, and secure protection for your most valuable asset — your home.

State Farm offers strong customer service, flexible coverage options, and excellent discounts, making it one of the top choices for American homeowners. By following the strategies in this guide, you can save significantly while ensuring your home and loved ones are protected from life’s unexpected events.